Lee DeVito

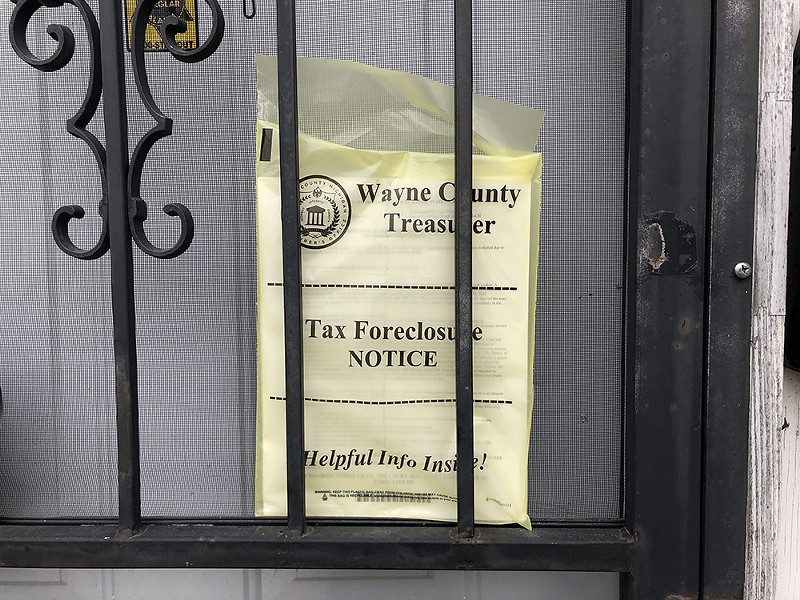

Fewer than 100 Detroiters are at risk of tax foreclosure this year because of assistance from a state program.

More than 4,200 homes in Detroit that were at risk of being foreclosed for delinquent property taxes won’t be seized because of an unprecedented partnership between activists and government officials.

The Michigan Homeowner Assistance Fund (MIHAF), a new federally funded state program, provided more than $12 million to Detroit homeowners who were behind on their property taxes.

As a result, only 97 owner-occupied homes in Detroit are at risk of tax foreclosure this year, according to Wayne County Treasurer Eric Sabree.

By comparison, tens of thousands of homes — or one of every four houses — were tax-foreclosed in Detroit between 2011 and 2015.

Sabree said saving thousands of homes from foreclosure would not have been possible without the help of volunteers who knocked on doors, made thousands of phone calls, and sent out mailers notifying homeowners of MIHAF.

The Wayne Metro Community Action Agency and the Coalition for Property Tax Justice led the effort and are working to save the remaining 97 homes from foreclosure.

“These outreach efforts are making a huge, huge difference,” Louis Piszker, CEO of the Wayne Metro Community Action Agency, said at a news conference Thursday. “We’re currently processing more than 2,000 applications from Detroit residents.”

MIHAF was launched last year with $242 million from the American Rescue Protection Act (ARPA). The program expires in 2026, but officials suspect the money will run out by then.

“The funding allocations won’t last that long,” Sabree said. “That’s why where’re urging everyone who is eligible to apply.”

To be eligible, homeowners must have experienced a COVID-19 hardship, such as earning less money or paying more for expenses, and earned less than 150% of the poverty level. For a family of four, that equates to a household income of $50,000 or less.

Activists and elected officials also successfully lobbied the state to allow homeowners who owe taxes from 2019 or earlier to be eligible. About 6,000 Detroiters have delinquent property taxes dating back to 2019 or earlier, Piszker said.

Activists said the funds are critical because many Detroiters with delinquent property taxes were illegally overassessed. The Michigan Constitution prohibits property from being assessed at more than 50% of its market value.

Between 2010 and 2016, the city assessed properties at as much as 85% of their market value. The inflated property tax assessments resulted in an estimated 100,000 Detroiters, most of them Black, losing their homes to foreclosure.

U.S. Rep. Rashida Tlaib said the over-assessments are a significant reason why Detroiters are losing their homes and fleeing the state.

“Michigan led the nation in the loss of Black ownership,” Tlaib, D-Detroit, said. “This is something we have to look into more.”

Activists said they need to spread the word about MIHAF.

“So many Detroiters are dealing with delinquent property taxes but don’t know about the services,” Bernadette Atuahene, a member of the Coalition for Property Tax Justice, said. “It’s up to us to tell each other about these services. We have to get the word out."

For help applying for MIHAF, homeowners are encouraged to call 313-244-0274.

Coming soon: Metro Times Daily newsletter. We’ll send you a handful of interesting Detroit stories every morning. Subscribe now to not miss a thing.

Follow us: Google News | NewsBreak | Reddit | Instagram | Facebook | Twitter