"They justify their existence because they want to be something different from the mayor and council," he says. But the bigger problem, he adds, "is you're diverting funds that otherwise would've gone to the city's general fund." Typically, that's tens of thousands of dollars being captured for economic development, rather than being used for city services. In Detroit's case, it's millions.

***

By February, when City Council was asked to transfer land valued by the city at $2.9 million to the DDA for $1 in return to move the Red Wings arena project along, key negotiators in the deal were offered some criticism by Nancy Kaffer, columnist at the Freep. She wrote that the DEGC had "dropped the ball" in negotiations.

"It is the lead negotiator for nearly every downtown development, including this one, and if it pushed for community benefits," a firm agreement activists wanted the Ilitches to consent to, "it wasn't successful," she wrote, later adding: "As a nonprofit, albeit one that's largely funded by taxpayers, the DEGC operates with a notable opacity. It is not subject to requests for documents made under the Freedom of Information Act, for example, and the agency does not typically make information about negotiations it is conducting public."

DEGC chief Jackson didn't take kindly to Kaffer's words. In a response published by the Freep, he wrote the Red Wings arena is "likely the most-scrutinized development deal in decades."

The reasons, Jackson said, were simple.

"The enabling state legislation passed more than a year ago," he wrote. "The rough draft of the development deal was presented more than seven months ago. Decisions about it since then were made by four public bodies that held at least nine public meetings.

Resolutions, actions, minutes, agreements, and more for the public entities, including the DDA and Detroit City Council, "are all available to the public," Jackson continued.

"Nothing the public needs to know has been withheld," he contended.

It bears mentioning that the Michigan Strategic Fund, which is expected to issue bonds for the project, does post meeting minutes and agendas online. Detroit City Council meeting agendas can, if requested, be sent by email or can be found online, though the city's website is difficult to navigate, a point acknowledged by Mayor Mike Duggan's administration.

However, the DDA, and the Economic Development Corporation (EDC), another board the DEGC operates, don't post meeting agendas or minutes online. Asked why, the DEGC said, "It's not required by law." The Detroit Public Library stores DDA minutes and agendas, but only through 2007. More recent years, apparently, require a request to the public authorities, likely through a FOIA request.

And while it's true those particular documents can be made available, that requires another unusual time-consuming affair: Separate requests for records of public authorities the DEGC oversees must be made to the DEGC's Papapanos, who serves as the FOIA coordinator of all seven boards.

When Metro Times requested information earlier this year related to the total amount of TIF money captured by DDA districts and several authorities the DEGC operates, the initial request was inadvertently made solely to Papapanos, the DDA FOIA coordinator.

In response, Papapanos provided documents for the DDA only, adding, "The DDA is not able to respond on behalf of any other public body." When four separate additional requests were filed, all made out to Papapanos, serving in the capacity as FOIA coordinator of the respective boards whose information was sought, the documents were then sent.

And the public would have to attend a meeting to know who sits on the DDA's board, a group appointed by the mayor and approved by Detroit City Council, as the listing of the DDA's board members on the DEGC's website doesn't represent the current makeup of the board. Mayor Duggan issued his appointments in March, and board members were sworn in soon after, according to meeting minutes.

"Municipal authorities are regulated by state law and the DDA and other authorities administered by DEGC take the necessary steps to comply with state laws and regulations," the agency says in response to a question on what steps it takes to ensure there's transparency with the DEGC, as well as the public authorities it staffs.

The DEGC's relationship with the city also raises another concern: the potential for conflicts of interest related to the arena deal, considering the scope of overlapping connections related to the arena deal between the DEGC, the DDA, the Ilitches, and the Downtown Detroit Partnership (DDP), a nonprofit that consists of major business CEOs, civic leaders, and Detroit officials focused on implementing programs and initiatives downtown.

According to its website, the DDP's 12-member executive committee includes George Jackson, and Christopher Ilitch, of Ilitch Holdings. In the past, numerous members of the DEGC and DDP have held positions on each board and, occasionally, the public DDA.

The DEGC says it maintains a conflict of interest policy, but it generally pertains to "individual, financial conflicts of interest. That is, votes in which a board member has a direct financial stake."

Regarding the occasional overlap, the DEGC says, "It is not unusual for non-profit organizations with some common interests to have common board members."

***

In recent weeks, the DEGC, and by extension, the DDA, have continued to finalize the financing of the new Red Wings arena through negotiations with the state and the Ilitches. The discussions have brought about the possibility of an entirely new financing structure — all of which have yet to be reported by local media.

As it was revealed last week in a request for proposals (RFP) issued by the DDA for a "swaps consultant," the authority may now issue $200 million in bonds (read: borrow money) to finance a portion of the project, which would be paid off with the Ilitches' $11.5 million annual contribution, according to Papapanos, in a brief interview after a recent DDA meeting.

The DDA was searching for a consultant because it's now considering the option of entering into what's known as an interest-rate swap agreement. That would allow it to secure, and pay, a fixed interest rate on the bond payments, rather than a floating rate.

A swap is essentially a bet. It's aimed to secure a fixed interest rate, assuming a benchmark interest rate used by financial institutions across the world will rise, rather than fall. Such agreements have been scrutinized to no end in Detroit's ongoing municipal bankruptcy case, as the city entered into complex interest rate swaps to secure financing for its pension funds, only to have the gamble turn sour: The city was saddled with a $50 million annual payment for its fixed interest rate to the banks that organized the swap, according to published reports — with nothing in return, because the floating interest rate the banks were paying had plummeted.

In the RFP, the DDA wrote of the proposed deal that "The purpose of the swap is to mitigate interest rate risk and synthetically fix the rate of interest of approximately $200 million of floating rate bonds."

The swap would last roughly 30 years, and would allow the DDA to pay a fixed rate of interest to a counterparty that would later be identified by the Ilitches, according to the RFP, and, in return, receive a variable rate based on LIBOR, the London Interbank Offered Rate, an interest-rate benchmark.

According to Heber Farnsworth, associate professor of finance at the Penn State University Smeal College of Business, it's possible the Ilitches would get to choose the counterparty involved in the swap because the creditworthiness of the bonds may be more appealing with arena revenue securing payments.

If the DDA actually pursues the swap, Farnsworth says the authority would then come to an agreement with the counterparty as to what both sides believe the LIBOR rate will be when the swap kicks in — likely in 2018, according to the RFP.

Farnsworth offered a possible worst-case scenario if the DDA's bet headed south: For instance, if the LIBOR rate drops, the DDA could be stuck with paying a fixed rate, while receiving a smaller amount in return from the counterparty. If that happens, and the DDA is on the "losing" side of the bet, it might have to post collateral — similar to how Detroit posted its casino revenue when the city's infamous interest rate swaps went sour.

If the DDA were to then miss a swap payment, the counterparty could simply "seize all the collateral," Farnsworth says. But whatever the DDA could possibly post as collateral is entirely unknown.

In Detroit's case, to end its swaps agreement, the city had to pay $85 million to terminate. For the Detroit Water & Sewerage Department, the termination fee for its bad gamble cost $571 million.

The potential ramifications of the proposed swap are unknown, but Farnsworth says one thing's for certain: Over the next 30 years, the LIBOR rate will rise and fall — again and again. The DDA's proposed swap would terminate in 2045, according to the RFP.

However, if the LIBOR rate rises, Farnsworth says, the DDA would be in a position where it's receiving more from the counterparty than it's paying in return. Why exactly the DDA will potentially pursue a swap for bonds secured by the Ilitches' revenue from the arena, and not the public money involved in the project, is unclear.

Asked why the financial structure of the deal could change, Morante, of the Michigan Economic Development Corporation, said in a recent statement that "We are working on a deal and have talked about a number of things but nothing is concrete. We will be happy to address any questions when all of the details are approved by all involved."

And that's happening soon. At the DDA's bimonthly meeting on Aug. 27, the DEGC's Papapanos said the authority's board could take action on the final financing package for the arena as early as its next meeting, Sept. 10.

Pressed for comment to help enlighten the public about what exactly is going on here, the DDA — or, the DEGC on behalf of the DDA — says the RFP for a swaps consultant was required under federal law. The RFP was posted on Aug. 26; the deadline for responses was Sept. 3.

In a statement to Metro Times, the DDA confirmed an interest rate swap was being considered as "part of the overall financing" for the new arena.

But exactly why was this even more convoluted financial scheme being considered this late in the game?

The DDA's response left much to be desired: "Any comment on the details of a possible swap agreement beyond the references in the RFP would be premature."

In other words, we'll know what, if any, risks the deal could pose after it's been made. — mt

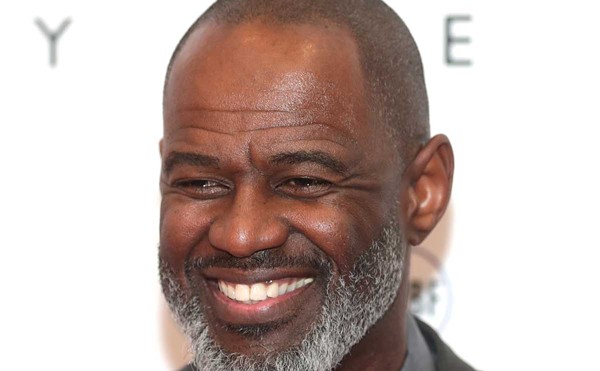

Ryan Felton is Metro Times' investigative reporter.

About this report:

Even though the DEGC isn't a public entity, documents the nonprofit must produce for the state and federal government can be obtained through a number of agencies, offering added insight. And so this story was largely developed from what's available for public consumption, including court records, IRS disclosure forms, documents on file with the Michigan Attorney General, city records, documents located at the Detroit Public Library, and other records obtained through the Freedom of Information Act.