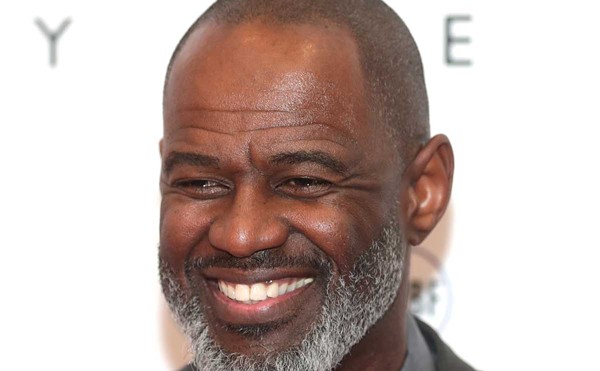

A group of Detroit residents and the Detroit Eviction Defense coalition gathered in New Center on July 11, 2014 to protest against an Oakland County developer currently locked in a court case with those residents. (Ryan Felton/Metro Times)

A group of Detroit residents today called on an Oakland County developer to sell them homes they've lived in for years -- homes they say they should've owned by now.

The developer, Peter Barclae, contends otherwise.

Barclae built the homes, known as the Gratiot McDougall project, back in 2006. Both parties are locked in a legal battle in Wayne County Circuit Court, a case that will likely depend on the judge's determination if the language of the contract those residents signed legally holds up and entitles them to homes they currently live in.

"He hasn't honored the contract -- the purchase agreement -- for the last seven years," says resident Sheree Bass. "He wouldn't sell still to this day."

What appears to have led Barclae’s tenants to sue him was a collapse in the funding his project depended on, with almost half of the federal money he anticipated never materializing due to program requirements not being met by the city of Detroit, according to court records.

Initially, Barclae tapped additional financing with Charter One Bank to supplement construction costs of the Gratiot McDougall project -- an estimated $3.4 million. Along with the HUD funds, "the mortgages the tenants were supposed to get where to pay off the Charter One loan with the tenants ultimately becoming the owners of each property," according to Barclae's attorney. Five of the properties were eventually closed on. Barclae guaranteed about 58 percent of the loan from Charter One, the HUD HOME program would cover the rest, according to his attorney. When the city failed to meet requirements of the U.S. Department of Housing and Urban Development’s HOME Investment Partnership Program to administer the funds, the feds pulled funding for the projects.

But, says Bruce Foster, who spent a decade in the housing services division of Detroit's planning and development, HUD should step up and play a role in the situation.

"I think HUD really overreacted by pulling all the money for those projects," says Foster, whose office handled HUD money for the city. Foster says the city's misstep -- failure to conduct an environmental clearance -- amounted to a posting in a local newspaper. "I think [HUD] really has an obligation to come in and help fix this," Foster says.

Resident Antoinette Talley (seen in the video below) says the residents were sold on a homeownership program, not to occupy the Gratiot McDougall homes as renters. And, she says, each resident spent time essentially designing the homes -- from the carpet to the aluminum siding.

"You don't do that for renters," she says, adding, "These homes were custom built for us. These are not just our homes, there are our babies."

Last month, the residents and the Detroit Eviction Defense coalition -- which consists of homeowners, community activists, local unions and faith-based organizations -- successfully lobbied a Singapore-based developer, Midas Development Corporation, to remove the homes from a sale listing on their website. Midas had signed a purchase agreement with Barclae and paid a deposit, and was moving toward closing on the homes, until litigation was filed on behalf of the homeowners in February. Prior to the lawsuit, Barclae hired a property manager to commence eviction proceedings, but those were stayed when the case was filed.

It was around this time that some of the residents stopped paying rent. That’s with good reason, says Fluker. “They were trying to evict [the residents] during that time period, and there were numerous people alleging we should get the rent,” she says, adding, “[The residents] didn’t even know who had legitimate ownership.” That, in part, the residents say in court filings, is because Barclae was in tax foreclosure on a number of the properties. Barclae's attorney, Allen Dyer, told Metro Times last month the residents owe "approximately $200,000" in back rent, which, if received, would ensure the developer wasn't "behind on taxes."

On Wednesday, Dyer filed a motion for a partial release from an escrow account that was established last month, which residents will be pay stipulated rental fees into until further notice. A hearing on the motion is scheduled July 25 in Wayne County Circuit Court before Judge Leslie Kim Smith.