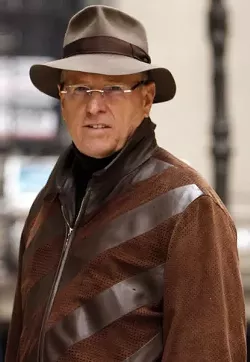

If the nation’s top newspaper publishers could have played nice back in the early 1990s, the Tribune Company would not be bankrupt, newspapers would not be dying, and Google would, at least, look very different today. This is according to James O’Shea, who has written a new book about the disastrous merger of Tribune and Times Mirror Corporation, called The Deal From Hell (Public Affairs, hardcover).

O’Shea joined the staff of the Chicago Tribune in 1979 and rose to become its managing editor in 2001, shortly after the Tribune bought out the much larger Times Mirror. The merger was trouble from the start, and the company sold itself to real estate investor Sam Zell in 2007 for about $13 billion, almost all of it borrowed. To make those heavy debt payments, Zell and his people demanded even larger cuts to the company’s staff, particularly to the reporters at its newspapers, including the Los Angeles Times, Orlando Sentinel, Hartford Courant, and our own Baltimore Sun. Those cuts decimated the news-gathering abilities of the papers and sapped morale. To manage the sprawling company, Zell employed a veritable morning zoo of former radio-station managers who, when not penning unintelligible memos, allegedly spent their working hours sexually harassing female staffers. This failed to improve the company’s business prospects, and Tribune filed for bankruptcy protection in 2009.

O’Shea’s book chronicles the events of the past decade and places them within both companies’ storied and proud histories. Short-sighted, Wall-Street-oriented management killed the newspaper business, he argues—but it started at least a decade before the ugly denouement.

In 2006, O’Shea was named editor of the Los Angeles Times, one of a succession of editors who came and went during the grueling years of the last decade; he lasted about 14 months. O’Shea took a Harvard fellowship after leaving the Times, then, in 2009, started the Chicago News Cooperative, which currently supplies full pages of Chicago news to The New York Times each week. O’Shea will speak at Johns Hopkins University on Nov. 10. City Paper spoke to him by phone on Nov. 3, and what follows is a slightly condensed and edited account of that conversation.

CITY PAPER : What is the Chicago News Cooperative?

JAMES O’sHEA: The idea was to create a nonprofit . . . membership cooperative, so we’re not asking people to pay for content, we’re asking people to join a cooperative, one of the benefits of which will be a web site with what we call news interest networks—using social networking to organize around an interest in the news. So if you’re interested in, say, education in Chicago . . . we would provide you with detailed education coverage that you can’t get anywhere else because newspapers have been cutting back.

CP : And you have like 25 reporters or something?

JO: No, we have about 20 people writing for us, about 15 to 18 of them are reporters or editors, but the bulk of them are freelance.

CP: So, how’s that plan working?

JO: We’ve been in existence for just two years. We kind of had to change our plans a little bit. We entered into this agreement with The New York Times, which was looking for a local partner to supply copy for the paper that circulates in the Midwest. So we said OK, we’ll have money from content sales, and we’ll get some money from memberships, we’ll get some money from sponsorships, and donations. So, we are just now kind of at the point. The Times wanted to get up and running fast, because they were worried that Rupert Murdoch was going to put local content in The Wall Street Journal [in Chicago], like he did in New York. So we had to move quickly, and we didn’t raise the kind of [seed] money we had planned. . . .

CP : So you’re saying you would have liked to have gone around shaking the can for a year or two before you started posting stories, just to build up some cash?

JO: Yeah. It’s probably wise to get about three years’ operating funds in the tank before you start. We just basically have less than a year. So we’re kind of gambling that we’ll be able to raise the money. So right now we’re kind of at a critical phase.

Cp : What are the lessons for everybody in the Tribune Company bankruptcy?

JO: One of the lessons that I would have learned out of it was don’t put all your eggs in one basket. [Newspapers generally] became so reliant on advertising revenue . . . so when your big source of revenue goes out the door and you tell people, “Well, now you’ve got to pay for [web] content,” but you’ve already conditioned them to not pay for content. . .

Secondly, I kind of viewed a lot of these guys as they kind of lost their soul. You really exist to serve the public. That’s not just something you happen to do to make money. Your whole idea is, I’m going to go out and produce good journalism, and if I produce good journalism I’ll have readers, and if I have readers I’ll have advertisers . . . and income.

CP : By “these guys,” you mean . . . ?

JO: I’m talking about the people on the business side of the paper. The financial guys. They were kind of performing for Wall Street.

CP : What was your opinion of Ben Bagdikian’s [1983] book The Media Monopoly?

JO: When I first joined the Tribune [in 1979], it was still a private company. And I got to the point where I thought, if you can run a paper and still make a lot of money that’s fine, just so long as you’re producing good journalism. We [journalists] didn’t pay enough attention to the kind of arguments that Bagdikian was making. In the newsroom you hear [about], and I talk about it in this book, the wall between business and editorial, and we were pretty comfortable with that. It shielded us from having to think about making it go as a business. So our voices were not really heard that much, because we weren’t in the room, because we chose to stay out of the room, or somebody chose to keep us out. And I think that was damaging, because the business [side] needed to hear from journalists, and journalists needed to weigh in on business decisions, and [journalists] should have become aware of the threats to the business model that developed. We didn’t take them seriously enough until it was too late.

CP : Can you expand on this?

JO: The wall existed for good reasons, historically. But we [journalists] were kind of a mystery to [the business side of the paper] too. When they look at our budget, they . . . would say, “Well, really, do they need all those editors? Do they really have to have two people checking every story—can’t you do it with one?” And because there was really no relationship across that wall, it kind of inhibited a lot of relationships. [The business side] didn’t have the background. And it would hurt us too, because they’d say, “Well listen, man, this classified ad thing is going away,” and we’d think, “Well, they always say that every time the economy’s bad, blah blah blah,” so we all just merrily skipped along—into the jaws of a complete disaster.

CP : When I started as a reporter, in 1988 at the Providence Journal, we had reporters you just never heard from. One was purported to be up in some office writing novels. One guy was doing people’s taxes. Were newspapers just too fat and lazy?

JO: Probably. But I think it was the way we reacted to the internet . . . that really hurt us. If you look at the newspaper industry itself, there is an incredible lack of [research and development]. Everybody kept thinking that this was gonna last forever.

CP : In your book you write, “The conventional wisdom is that newspapers—and by that I mean the credible, edited information they deliver, and not just the paper and ink—fell into a death spiral because of forces unleashed by declining circulations and the migration of readers to the Internet.” Is the industry in a death spiral? Or is it in a transformation?

JO: I think it’s—if you’re talking about newspapers? They’re in a death spiral until they can figure out a way out of this thing. And they haven’t yet. The problem is, with a newspaper, and people tend to forget this—when you strip away a lot of it, a newspaper is a manufacturing business. It has a product that it puts out every day. The steepest cost is putting that paper on somebody’s doorstep. The trucks, the drivers, the newsprint . . . everything like that is 80 or 90 percent of the cost. You can’t continue that as long as you charge only 25 percent of the cost to put that paper on their doorstep and rely on advertising for the rest.

The economics of advertising online are different. That advertising is not coming back [to newspapers]. So you need to figure out how to get people information that’s so valuable that they’re willing to pay a little more for it. And I think that’s really what I’ve been trying to figure out here at the news co-op.

CP : Seems simple. Just charge. That’s what The [New York] Times is doing.

JO: Yeah. I think you’re seeing more and more papers starting to do that. That’s probably a good thing to do. People say, “Oh, they can’t.” But the reality is that newspapers still generate most of the news.

CP : Why did you quit the LA Times?

JO: I didn’t quit LA, I got fired. We had a difference of opinion about the future direction of the paper. I thought that this process of, “We aren’t gonna hit our cash-flow targets so we’ve got to cut the budget again,” I didn’t think that was a path forward. I thought we needed to figure out new ways to get revenue. . . . I said, “Look, we have a revenue problem, and we keep treating it like it’s a cost problem.” They were tired of hearing that kind of stuff. They just wanted someone who would cut the budget very steeply.

CP : Did you have a PowerPoint presentation and a plan for how to get more revenue?

JO: I didn’t have a plan—but I had a pretty good idea of where I wanted to go. But we had just been taken over by Sam Zell, and it was a heavily leveraged buyout.

CP : Yeah, when I read that plan back then, I thought, Wow, he just took everyone’s pensions and told them they own the company—but it’s $13 billion in hock.

JO: Actually, you gotta be careful about that, because he didn’t take anybody’s money—not yet, at least. But what happened was . . . everybody had a lot of their stock invested in the Tribune company—the employees were the second-largest stockholders when Zell took over. So when he took over, he bought all that stock [at $34 a share] and they could put that all in the IRAs. When he created the ESOP [Employee Stock Ownership Plan], that was the pension plan going forward. So anyone who was working at Tribune at that time and was relying on the ESOP to be their future pension plan is out of luck, because that’s gone.

CP : You write that Tribune brass—folks like yourself—were intrigued by the idea that Trib would buy Times Mirror. What was the attraction?

JO: At that time the Tribune company throughout the ’80s and ’90s had bought up a lot of television stations. I think at the time of the merger, we had 20-plus TV stations. And we were paying big money for them, and everyone kept saying “Well, when are we gonna buy a newspaper?” And then the internet [was] coming along, and everything was consolidating at the time. AOL and Time Warner[-type] mergers. It was kind of like [buy] or be bought. We wanted to remain kind of independent.

And so the whole thought of having a national platform—the Chicago paper was a major Midwest newspaper, but it was kind of overlooked on the coasts. I thought we could do better journalism . . . and get more exposure and recognition for what we were doing. So from a journalistic point of view, I thought it was a really great opportunity. On the business side of it, they felt they could sell national advertising by capitalizing on the fact that they had newspapers based in Chicago, Los Angeles, and New York—but really they didn’t, ’cause they didn’t have a newspaper in New York City. They had Newsday, which is on Long Island. So I think it was a flawed idea. National advertisers didn’t want to buy a bunch of advertising in Chicago, Los Angeles, and Long Island. They would rather buy from the local paper there.

CP : I remember Tribune culture as practiced in Central Florida in the mid- to late 1990s. The Orlando Sentinel was a weak and predictable paper then going through spasms of trendy nonsense—putting reporters on TV, etc. The paper’s web strategy was so absurd that my paper, Orlando Weekly, hired its best online person away at about half her pay—so keen was she to leave. It was my impression that Tribune’s stock price—then beginning a serious runup—was fueled mainly by its Web 1.0 fantasies and the hype engendered by the first internet bubble. That bloated stock price, in turn, temporarily afforded Tribune’s bosses the belief that theirs was a much more powerful and competent company than it actually was, leading to the disastrous merger with Times Mirror. What is your recollection about Tribune’s corporate culture in the years leading up to the merger?

JO: Tribune was actually, in a way, in those years, pretty innovative. We were one of the first papers that went on the internet. The TV—I never had a lot of faith in that. But still it was a paper that was trying things.

CP : What was the New Century Network?

JO: That was Charles Brumback. He [was] looking, seeing down the road, that we’re going to have trouble for our journalism if we don’t get some money for it. So he wants papers to put all their content into the New Century Network. This was to be web-only, and operate sort of like a wire service. To get the information, you had to belong to the network and pay. Then it would split the revenue among the members according to what stories sold. This was in 1992, 1991.

CP : Pre-browser years.

JO: Right. So he gets all these news companies to join in. These companies still have a lot of swagger. We had The Washington Post, Knight Ridder, The New York Times, Times Mirror. We had a guy from Kleiner Perkins, the Silicon Valley company, and he thought it was a great idea. He was gonna put $5 million into it.

So that would have really changed things. . . . If we had done that it would have been much harder for Google to get started. . . . You would not have had free [news] content.

It didn’t happen because all the institutional egos in the industry didn’t take the threat seriously. They really didn’t see the threat coming.

CP : What’s happening in the Trib bankruptcy right now?

JO: Right now the bankruptcy judge just rejected both competing sets of plans for the company, and that has created a fascinating situation. There were two groups of creditors, and they couldn’t agree on a plan to get out of bankruptcy. The judge said he found a lot more to like in Plan A, which is the company’s plan. But he said they should have not said [they’re] not going to go and get money back from anybody who sold stock to Zell when he bought it, ’cause it’s not worth it on a cost-benefit basis. The judge said that’s not good enough. So now the company may have to go after the retirement funds of its past employees . . . to recover money for creditors, many of whom made millions in fees for lending money to the company. Of course, they lost most of the principle.

CP : But the idea—that they’d actually go after the everyday workers who sold stock five years ago—and against their will at that?

JO: It’s pretty stunning. A hearing is set for, I think, Nov. 22. [The judge has] kind of laid out in his ruling the things that the plan has to have for him to approve it. And the company has indicated that they’re going to come up with a plan that would satisfy his problems . . . key is that if the Plan B guys end up agreeing with that.

Edward Ericson Jr. writes for our sister publication the 'Baltimore City Paper'