Audio By Carbonatix

[

{

"name": "GPT - Leaderboard - Inline - Content",

"component": "35519556",

"insertPoint": "5th",

"startingPoint": "3",

"requiredCountToDisplay": "3",

"maxInsertions": 100,

"adList": [

{

"adPreset": "LeaderboardInline"

}

]

}

]

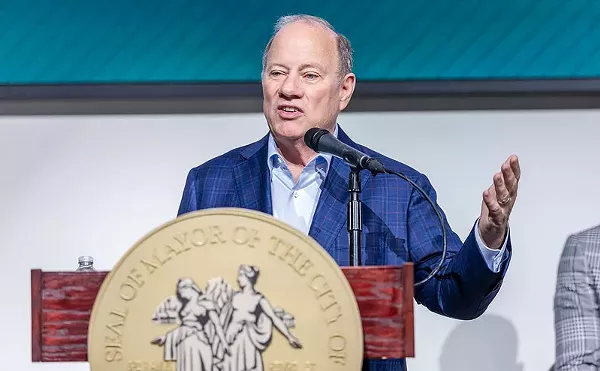

Highland Park Mayor Linsey Porter thought he had a workable plan for tearing down the city’s 500 vacant buildings. In 1997, following Porter’s lead, residents voted by a 2-1 margin for a special tax increase that would pay for razing the dangerous buildings.

Porter was elated to finally have financing for the demolition project. But now it looks like his plan, and not those abandoned buildings, may come tumbling down.

As one of his last official acts, former Attorney General Frank Kelley determined that the voter-approved, 5.9 mill "Quality of Life" tax increase is illegal. Before Kelley left office at the beginning of this year, he ordered the Michigan Department of Treasury to withhold revenue from Highland Park. In a letter dated February 8, the department said it will begin taking steps to recover the taxes by not releasing about $42,000 of state revenue-sharing funds to Highland Park.

Porter responded with a lawsuit challenging Kelley’s decision.

"I don’t know anyone in any government who can say we are wrong in what we are doing," said Porter during a press conference last week.

Demolition has been halted until the matter is resolved.

According to attorney Godfrey Dillard, who is representing the City of Highland Park and spoke at the press conference, municipalities have a constitutional right to tax citizens up to 50 mills, as long as the tax is voter-approved. The self-imposed tax will be in effect for five years and is expected to generate about $600,000 per year.

"The Michigan Constitution says that municipalities can tax themselves," said Dillard. He also said that Kelley’s "narrow" interpretation of Michigan law only allows municipalities to raise taxes for garbage pickup, libraries, aid to the elderly, and the police and fire pension funds.

"It needs to be challenged because it prevents small minority communities from taking corrective action on some problems," said Dillard.

Chris DeWitt, spokesperson for Attorney General Jennifer Granholm, says it is not clear whether the millage increase is illegal.

"I think that will be decided based on the outcome of the lawsuit," said DeWitt.

The lawsuit Highland Park filed against the attorney general’s office and the Department of Treasury asks the court to decide whether citizens can legally tax themselves to raise demolition dollars. That ruling will not be issued for some time. However, Wayne County Circuit Court Judge Sharon Tevis Finch, who will decide the case, did grant a Temporary Restraining Order (TRO) February 18, preventing the Treasury Department from withholding any funds from Highland Park.

DeWitt said that Granholm may try to have the TRO lifted.

"That is something we would look at," he said. "What steps will be taken, it is a bit early to say."

According to Porter, it will cost about $3 million to tear down Highland Park’s 500 vacant and abandoned structures. He said about 75 buildings and homes were demolished in 1998 at a cost of about $300,000.

"Our main focus is to get rid of abandoned, vacant homes in the neighborhoods," said Porter, who believes they pose a danger to the community. He cited a series of murders in 1992, when 11 African-American women were dragged into abandoned buildings, raped, and killed, as one reason the structures need to come down. He also said that about 85 percent of the fires in Highland Park in the last three years were at vacant houses. By eliminating several abandoned homes on Pasadena Street – known as "crackadena" because drugs were rampantly sold there – drug trafficking decreased considerably, said Porter.

"We want the right to continue doing what we have been doing," he said.